Showcase

Aunest is a perfect amalgamation of giving the best ecosystem to build your gold

assets without compromising your jewelry aspirations. Choose a Gold fund that suits you start SIP

regularly. Shop for any jewelry and for that value, you can transfer the accumulated gold units and make

the jewelry yours.

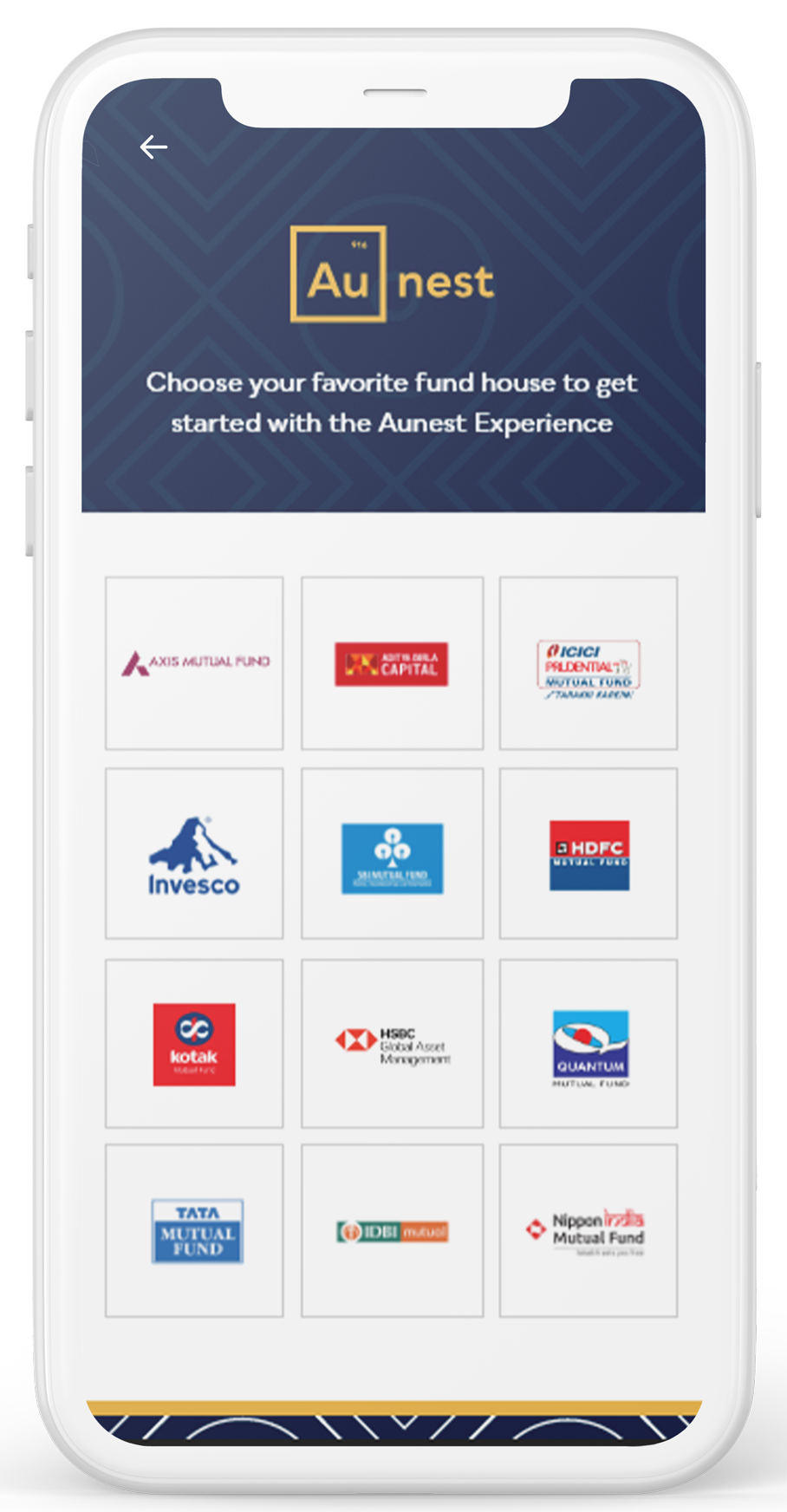

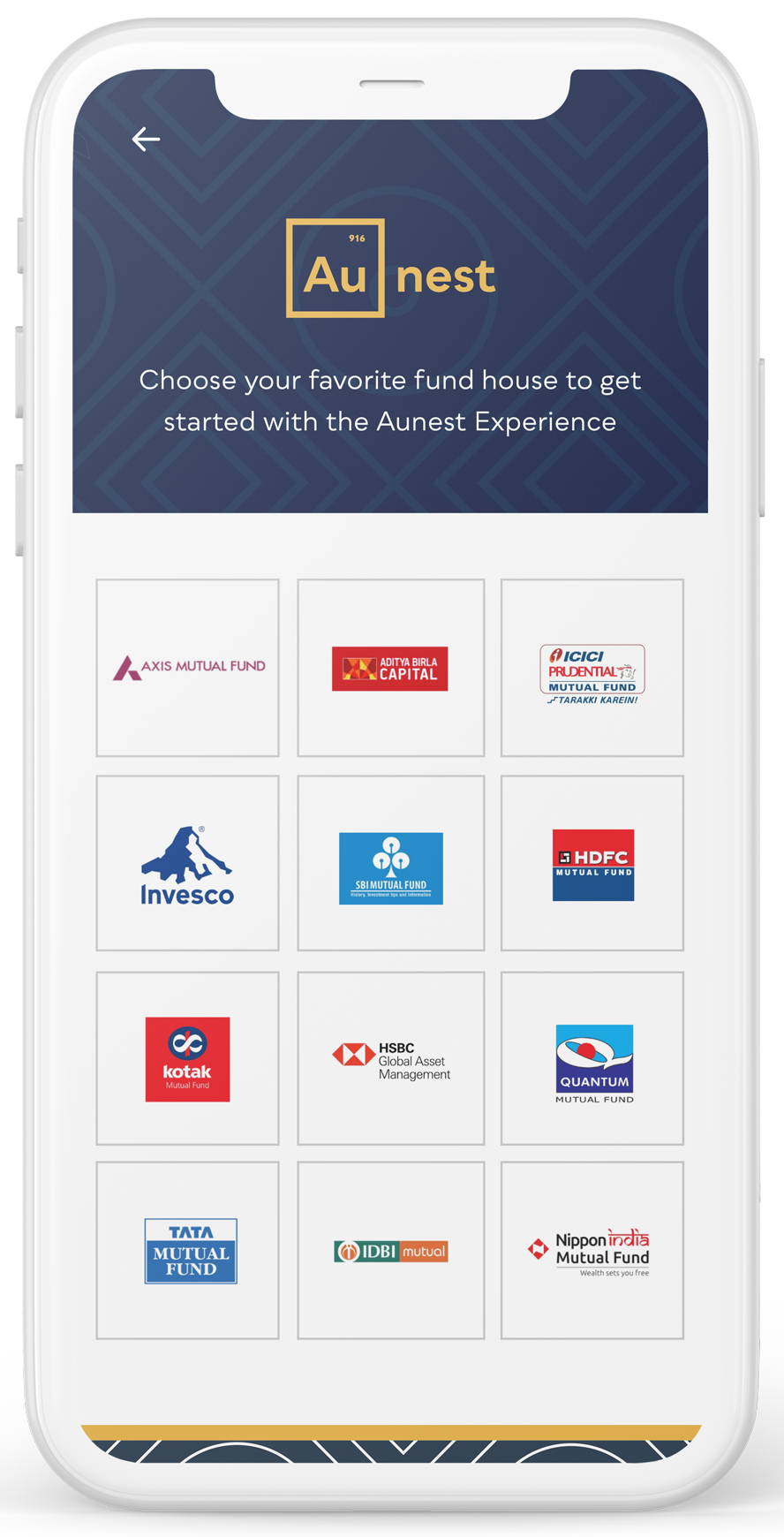

Gold Fund Marketplace: Invest in Gold, the Smart Way

The world is catching on. Gold is no longer just a safe haven; it's a full-blown asset

class, with Gold ETFs seeing unprecedented demand. We make it brilliantly simple

for you to get in on the action.

● Gold Mutual Funds – The ‘Set It & Forget It’ Glow-Up.

SIPs from just ₹100? You got it. Let expert fund managers grow your gold

while you focus on living your life. It’s wealth-building on autopilot.

● Gold ETFs – For the Market-Savvy Mover.

Love the thrill of the trade? Track prices in real-time and make your move.

With Gold ETFs, you're in the driver's seat of your gold portfolio.

● Digital Gold – Pure Gold, Zero Hassle.

Build your stash gram by glorious gram. Buy, sell, or hold 24K digital gold

instantly, all stored in ultra-secure, insured vaults.

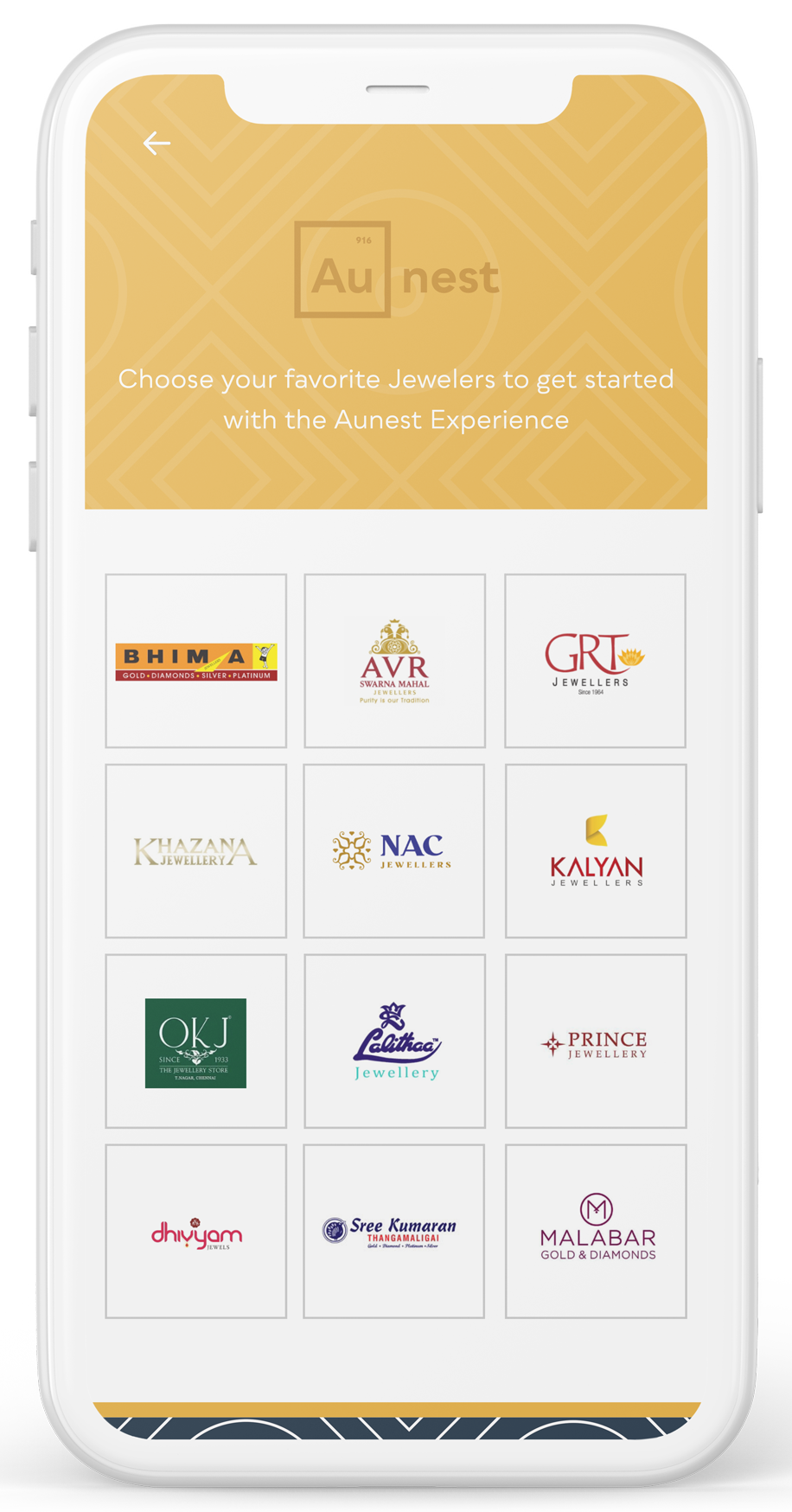

Gold Jewelry Marketplace: Your Screen Is Now a Jeweler's Window

Forget endlessly scrolling through blurry pictures. This is an immersive gallery of

gold, curated from India’s most popular and trusted jewelers. We’ve built a digital

showroom so real, you'll forget you're on an app.

● Get Closer Than Ever Before.

Our stunning 360° 4K videos capture every spark, every curve, every

intricate detail. We’ve brought these masterpieces to life with such clarity,

the only thing separating you from touching the jewelry is your screen.

● From Savings to Sparkle, Instantly.

Meet Au Pay. It’s our magic wand that transforms your Gold ETF units and

Gold Mutual Fund holdings into the jewelry you love. See it, love it, and make

it yours in a single, seamless tap at checkout. It’s that simple.

● And for those who love the classic touch-and-feel experience, you can also

book an in-store visit to try on your shortlisted favorites.

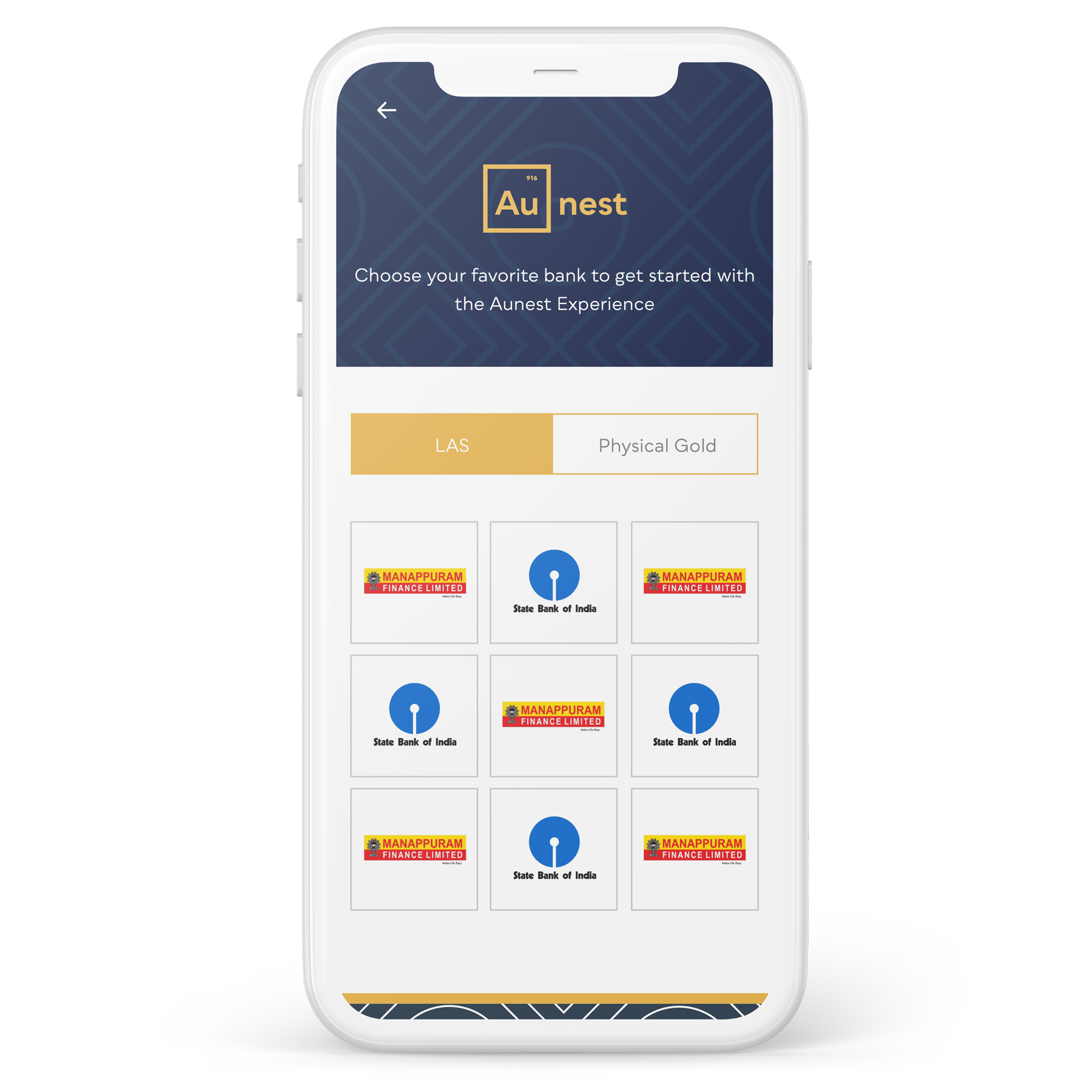

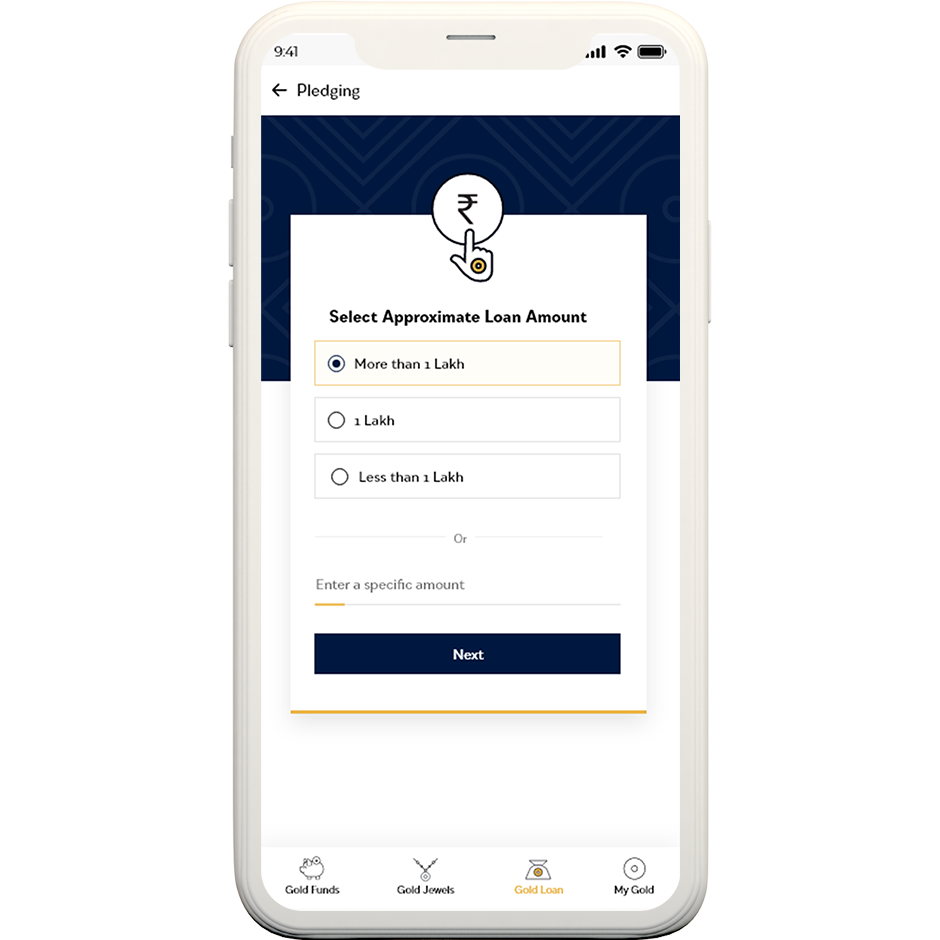

Gold Loan Marketplace: Gold Loans Without the Headache

We get it—life throws surprises, and sometimes your jewelry has to play superhero.

That’s why we’ve made it easy to explore gold-backed loan options right inside

Aunest.

Whether it’s a short-term need or a bigger life event, you can compare trusted

lenders, see interest rates clearly (without squinting), and apply directly. No shady

fine print. No “hidden handling fees.” Just straight talk and real choices to keep

your plans moving.

Your gold can work for you even when it’s not shining on you—and Aunest makes

sure it does.

● Compare with Confidence: Our Gold Loan explorer lets you transparently

compare interest rates and terms from trusted banks. No middlemen, no

hidden fees.

● Borrow from Your Couch: Apply right from the app. Our branchless model

guides you through a quick evaluation at home. Once approved, the funds

are transferred, and your gold is moved to a secure bank vault. Easy, fast,

and dignified

Au Pay: From Savings to Sparkle

● Finally, the gold you save and the gold you love are one and the same. Au Pay

is our magical feature that lets you redeem your Gold mutual fund, Gold

ETFs and Digi-Gold holdings into your favourite jewelry from our top-tier

partnered jewelers.

● It’s the power to say 'yes' to that perfect piece in a heartbeat—seamlessly

transforming your digital wealth from numbers into a stunning slice of

tangible, joyful memory, right when the moment strikes.

Invest with Purpose, Not Pressure

● At Aunest, we don’t believe in throwing numbers at you and hoping you figure it out.

Instead, we help you invest with real goals in mind—whether that’s gifting jewelry to

your parents, saving for a dream wedding, or just feeling proud of building something

of your own

● Use our special asset allocation calculator or our dream planning calculators to

build a smart, diversified plan that balances gold, ETFs and mutual funds based on

your life stage. No lectures, just suggestions that feel like, “Hey, you’ve got this.”

● Because money should feel like freedom—not friction.

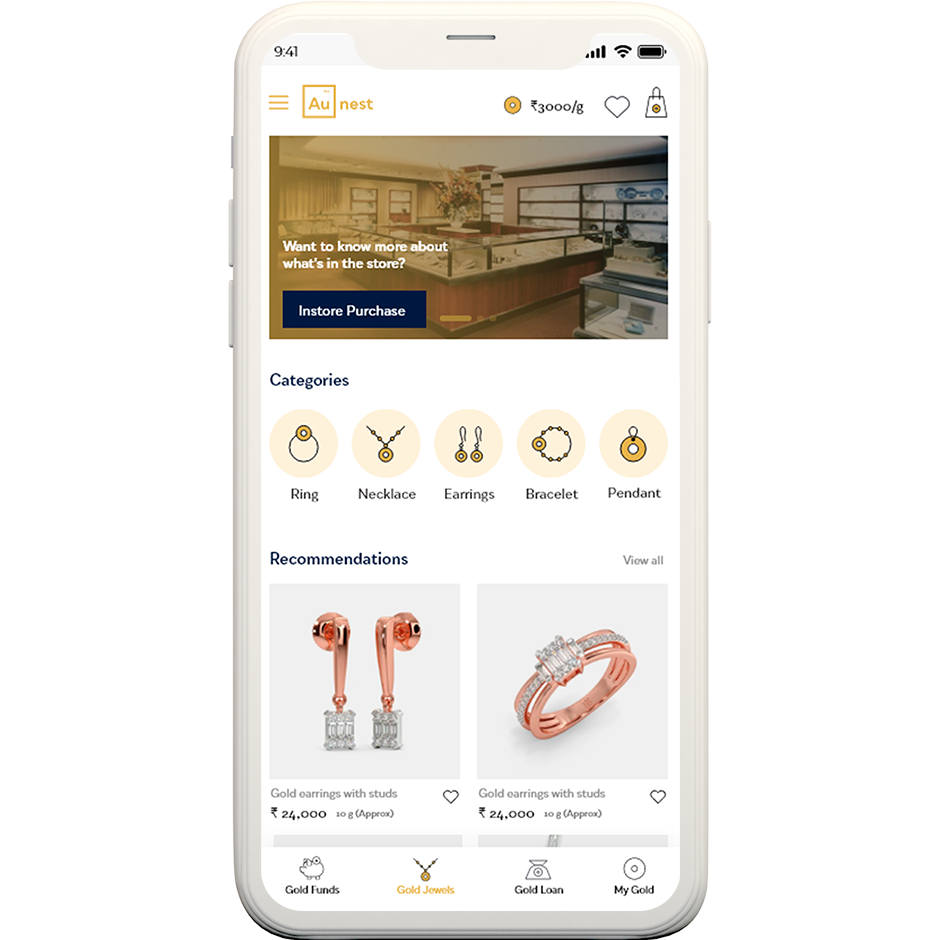

Screenshots

The User interface (UI) is designed keeping your needs in mind - to invest, to shop or

to take a gold loan. we promise that your experience (UX) will be delightful.

Download the App

Coming this Dhanteras – Let the new chapter of your wealth journey begin! ✨

Aunest is almost here—and it’s arriving with the sparkle of Dhanteras 2025, the perfect time

to begin something precious. As families across India welcome Lakshmi into their homes,

we’re inviting you to welcome a whole new way to invest—with heart, tradition, and a dash

of tech magic.

Get It Now

Thanks for your interest, remember your childhood thoughts

Aunesty pays off !!!

Latest News

Here we try to get you valuable and meaningful information on gold that you would like

to know about.

Statistics

This is a beta testing sample data; all our analytics plug in are DUT -Design Under

Test. We will be live by Mid night 01 December 2020

Happy Clients

1232

App Downloads

64K

Active Users

1811

Total Rates

232

FAQs

Get all the answers to the most frequently asked questions regarding Aunest App.

-

Once you invest in gold mutual funds, your money gets transferred to an AMC for

fund of funds (FoF). This FoF will invest the money into Gold ETF (Exchange traded

Fund) and ETF will buy the physical gold and store it in their vault on your

behalf.

-

Cut down the number of visits to stores. Select a fund of your choice and start

SIP or lumpsum your investments as low as Rs.1000/- all from your home.

-

If you have a trouble finding the fair price for your gold we are here with

perfect solution. Buy and Sell Gold units at the same rate which are based on the

current market NAV.

-

We at Aunest assure you 24 karat Gold with 99.5% Purity

-

Enjoy Risk- free Storage for your precious Gold safer than owning physical gold

with zero chances of theft. We reduce your risk by eliminating the hassles of owning

physical gold. through Aunest, you can view all your Gold Funds online.

-

Gold funds are the best investment option for you because they are highly

regulated. Gold Funds Asset Management Companies (AMCs) are under constant

supervision by SEBI (Security and Exchange Board of India and AMFI (Association of

Mutual Funds in India whereas digital gold is regulated by private management

trustees and custodians. The choice is your. Invest in either of them, based on your

judgement.